The problems

in euro area continue to exacerbate SNB’s monetary policy and to weigh on the Swiss economy. The question of

whether the maintenance of the minimum price of CHF 1.20 per euro is justified, is still a topic in Switzerland as well as abroad.

The Swiss

National Bank (SNB) wants to maintain the

minimum exchange rate of CHF 1.20 per euro and enforce it with the utmost

determination. According to its own inflations the SNB remains prepared to buy

foreign currency in unlimited quantities for this purpose.

The SNB

introduced a floor to the EUR/CHF exchange rate at 1.20 on 6th

September 2011. Since then the maintenance of minimum exchange rate per euro seems justified for the following

reasons:

(1) There is

no inflation risk. The annual inflation rate has been in negative territory

since the fourth quarter of 2011. The SNB forecast shows an inflation rate of

-0.5% for 2012. For 2013 the SNB is expecting inflation of 0.3% and for 2014 of

0.6%.

(2) Switzerland’s

foreign exchange reserves rose to a record level. The foreign currency reserves

make up now with total 365 billion CHF ($374 billion) around 70% des GDP. But there

is no theoretical limit to the amount of foreign currency reserves. The rate is

90% for Singapore and 120% for Hong Kong.

(3) The SNB

is able to diversify its reserves. In order to diversity its investments the

SNB included Australian and Singapore dollars as well as Swedish krona and

Danish krone in its investment portfolio. Since the first quarter of 2012 the

SNB has also been investing in Korean won. Furthermore the SNB is evaluating

additional investment opportunities both for bonds and for shares.

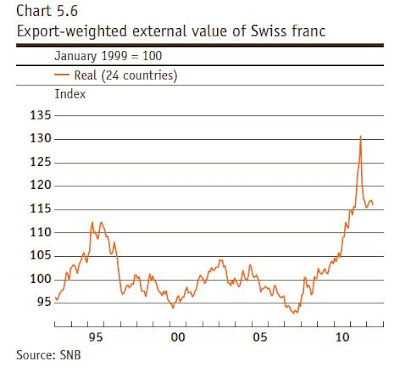

Export-weighted

external value of Swiss franc, Graph:

SNB in Quarterly Bulletin, June 2/2012

(4) By

defending the floor the SNB worked out to slow down the risk of deflation. The

deflationary situation was worsened past summer, especially in consequence of

the strong appreciation of the CHF. The drop in prices was caused primarily by

the appreciation of CHF. After the Swiss franc stabilized, its effect on prices

is likely to decrease in the second half of 2012.

(5) The SNB didn’t

lose money on foreign currency positions. The SNB hat reported a consolidated profit of CHF 6.5 billion for the first half of 2012.

Swiss Yield

Curve, Graph: SIX Swiss Exchange

Bottom line: The Swiss franc seems

still overvalued. The minimum exchange rate continues to apply without any

qualification. As the SNB perceives the substantial challenge for the Swiss

economy, which comes from the harsh austerity policy in the euro area, it will

not tolerate any severe impact on prices and the economy in Switzerland. It stands

ready to take further measures to stave off the risk of deflation. The SNB’s exchange

rate policy is absolutely credible. But the SNB’s another growing challenge is

the strong housing market which could begin to threaten financial stability.

Keine Kommentare:

Kommentar veröffentlichen